NEF offers additional financing solutions to help close the affordable housing gap in multiple ways that are aligned with our mission. Our expertise in pre-development lending, preservation debt and equity, and workforce debt and equity allows us to further assist our partners in expanding their efforts to provide low-income and moderate income rental housing.

NEF has diversified our product offerings to further amplify our impact on the creation and preservation of affordable housing and to assist our investor and developer partners as they seek to expand their efforts in providing housing for low and moderate income households.

Our workforce/moderate income rental housing products provide capital investments in existing multifamily and new construction housing that fills the needs of moderate income individuals and families in the “missing middle” who struggle to find affordable housing options in neighborhoods close to job opportunities.

Project financing can be structured in the form of equity, mezzanine or first mortgage debt, which enables prospective partners to acquire, renovate or develop projects where the majority of units are affordable for households earning 80% of Area Median Income (AMI).

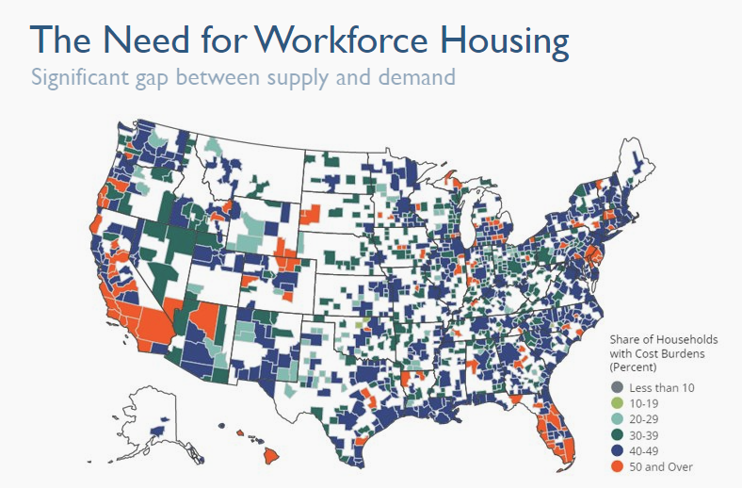

Source: Harvard Joint Center for Housing Studies, Even before the pandemic, many households were burdened by housing costs, 2021, www.jchs.harvard.edu. All rights reserved.

"Focusing on that 'missing middle,' where you don't have the huge federal subsidy, like LIHTC, to really support the development of affordable housing, aligned perfectly with our mission to develop creative solutions to expand the creation and preservation of affordable housing," says Daryl Shore, Head of Structured Financing at NEF, in the Mixed-Income Developments section of the June issue of Tax Credit Advisor magazine.

If you're interested in project financing in the form of debt, discover what NEF's workforce/moderate income rental housing financing solutions can offer at the link below.

If you're interested in project financing in the form of equity, discover what NEF's workforce/moderate income rental housing financing solutions can offer at the link below.

BRANDON MCCALL

VP Structured Finance, South & West Regions

Phone Number

Email

MARK MIGLIACCI

VP Structured Finance, East & Midwest Regions

Phone Number

Email

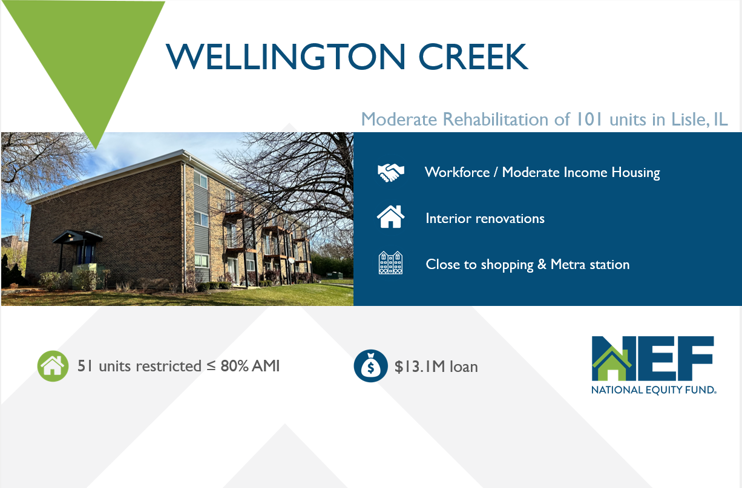

First constructed in 1965, Wellington Creek Apartments are located in the Chicago suburb of Lisle, IL and were acquired by Stone Beam Management using NEF's Workforce/Moderate Income Housing loan program. Comprised of four buildings and one single-family home, 51 out of 101 apartments are restricted to families with incomes at or under 80 percent of the Area Median Income (AMI), which helps make this an affordable place to live for households with moderate incomes.

Settled between two major interstates, Wellington Creek is less than two miles from downtown Lisle, which has a walkable shopping area and a Metra train station with service to downtown Chicago. This community is an ideal place for residents to live in proximity to where they work and job opportunities in the surrounding area and in the city.